The music industry is a complex one, with many different moving parts to keep an eye on. It’s difficult to comprehend, especially when it comes to royalties because according to Kobalt’s CEO, there are over 900,000 different royalty streams.

In recent years, companies like Royalty Exchange have launched to give artists an additional option for their fans to support them. Up until recently, royalties have been coveted and only collected by the respective copyright owners, which include record labels, publishing companies, and the artists themselves. But thanks to massive advancements in music technology fans can now pay an upfront fee of, say, $5,000 and become a partial owner in a track’s royalties alongside other investors.

Every musician and artist are different so it’s best to research each one so you understand which royalties you’ll have the opportunity to invest in.

This article will briefly go over the various types of music royalties and how you can invest in your favorite artist’s royalties, but first we need to clarify a few things before you decide if music royalties are a good investment for you.

Five Exclusive Rights as a Copyright Owner

Copyright law is a set of laws that protects the rights of authors and artists to their work. It gives the copyright owner five exclusive rights:

- The right to reproduce the work

- The right to create derivative works from the original work

- The right to distribute copies of the original work

- The right to perform or display copies of the original work publicly

- The right to sell or lease copies of the original work

Two Different Types of Copyrights in Music

There are two types of copyrights in music: the sound recording and composition copyrights. The sound recording copyright is for the sound recording (think of the MP3, WAV, and AIFF files) and is commonly owned by the record label or the artist (if they don’t have a record label). This grants them the right to distribute the song on a physical or digital format to stores like Apple Music, Spotify, and TIDAL, to name a few. The composition copyright is for the composition (lyrics, chords, and melody).

What are music royalties?

Artists and songwriters have multiple streams of royalties when it comes to their work. But what are royalties? And how do they work?

The first thing to understand is that there are different types of royalties that are collected for the sound recording and composition. Performance royalties are earned when a piece of music is publicly performed. In the United States, SoundExchange collects the royalties for public performances on sound recordings. ASCAP, BMI, and SESAC collect public performance royalties for the compositions. Note: ASCAP, BMI, and SESAC are not publishers.

Mechanical royalties, on the other hand, are earned when someone purchases a digital download from stores like iTunes and Beatport, among other things, and are only paid to the songwriters and publishers. Streaming services like Spotify and Apple Music pay for a blanket mechanical license for permission to list musicians’ music on their platform. In the United States, the MLC collects these royalties. However, if you’re signed up for Songtrust or another admin publisher they will collect these mechanical royalties for the songwriters and publishers.

Mechanical royalties for songwriters are complicated because they vary depending on the type of use. There’s also a distinction between statutory mechanicals, which only applies to songs recorded before 1972, and voluntary mechanicals, which apply to all other songs.

We could go on and on about the different types of royalties and how they’re collected, but this is just so you have a basic understanding of the main types of royalties in music.

How to Invest in Another Artist’s Royalties

Investing in another artist’s royalties is a way to diversify your portfolio. You can invest in the royalties of an artist that you like and are passionate about. After all, one of the number one rules about investing is you should only invest in people, companies, and products that you believe in. (I’m looking at you, Dogecoin!)

But why would an artist want to give up a portion of their royalties?

There are many reasons why an artist might sell their royalties. They may have a family to support, they need money for medical bills, or they just want to retire from the music industry (I don’t blame them). Another reason may just be that they want to provide their fans with another route to support them.

You can find artists who want to sell their royalties on platforms like Royalty Exchange. If there’s an artist that you truly believe in and want to invest in, reach out to them via email or social media and let them know you want to invest. If it’s something they’re interested in, you can discuss terms of the investment, if you will have any ownership, or receive royalty payments based on streams.

Investing in an artist’s project is a big feat and it can have its pros and cons, so be sure you do a fair amount of research beforehand.

What types of royalties can I invest in from musicians?

Since royalty investments are a new concept, the dilemma of what kind of royalties to invest in arises. There are many different types of royalties that musicians can invest in, and each one has its own positives and negatives.

The first type of royalty that you may be able to invest in is performance royalties. As mentioned above, public performance royalties are earned when an artist’s song is publicly performed on the radio, at a concert, or on television.

The second type of royalty that musicians can invest in is mechanical royalties. Mechanical royalties are earned when a musician’s song is sold as an MP3 download, CD, vinyl record, etc., and they go to the songwriters and publishers.

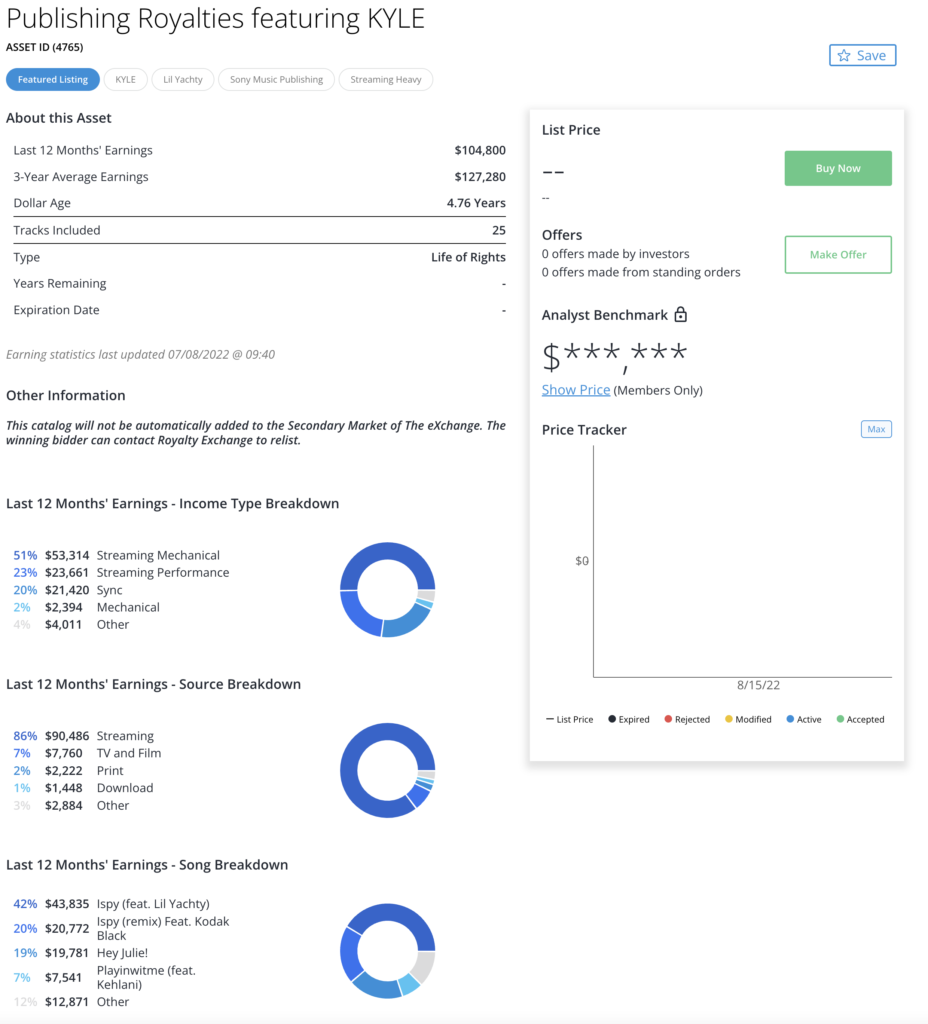

This artist KYLE has listed a portion of his publishing royalties on Royalty Exchange. We can see that in the last 12 months he’s earned a total of $104,800, at the time of this article’s posting. Here’s KYLE’s royalty breakdown:

- 51% is $53,314 for Streaming Mechanical

- 23% is $23,661 for Streaming Performance

- 20% is $21,420 for Sync

- 2% is $2,394 for Mechanical

- 4% is $4,011 for Other

How much money can I earn by investing in a musician’s royalties?

Investing in the royalties of a musician can be profitable, but it is not an easy task. It’s somewhat of a gambling game like the stock market is.

Royalty investing into an artist that isn’t earning much in royalties may not yield a return on your investment. However, an artist who has a good following or income from royalties, like KYLE above, may allow for a positive cash flow.

This number can also vary greatly depending on the popularity of the artist. An unknown artist that is beginning see some traction may be on the verge of gaining serious income, like if they land a huge sync placement. Kate Bush’s “Running Up That Hill (A Deal With God)” in Stranger Things 4 is a perfect example. Kate Bush has been around for many years, but her massive explosion for the track propelled her into the spotlight again.

Conclusion: Is it worth it to invest in another musician’s royalties?

Investing in a musician’s royalties can be a lucrative if you approach it correctly. Just like the stock market, you can easily lose a lot of money, or you can make a lot of money. (I’m looking at you again, Dogecoin!)

As we discussed in the section above, an artist with a very small following may not be the best investment when it comes to royalties. They aren’t earning much, so that means you won’t earn much, but that can change with one massive sync placement or a viral TikTok video. However, investing in an artist like Prince, The Beatles, or David Guetta, you’re most likely set up for success, but your initial investment will most likely be significantly higher for potentially less of a percent.

Remember, only invest what you can afford to lose and conduct a lot of research before you throw your money at something. *cough* SHIBA INU coin *cough*